Marcelo Montecinos

A new law project has been introduced into the Chilean Parliament that could change how the actual AFP pension system is run, and by whom.

Senator Alejandro Navarro and the NO+AFP Movimiento introduced a new constitutional reform bill to Parliament that was approved by Senado de la República (The Senate) on May 13, 2020. It will now be debated by a Constitutional Commission.

If Bill 13.493-13 gets approved, it would create a new public pension system that would be run by the government, same as in most countries around the world. This would be a major victory for Chileans that have been protesting for the change.

The current pension system is mainly administered by private foreign insurance companies (4 of 6) that are guaranteed, by law, a juicy profit.

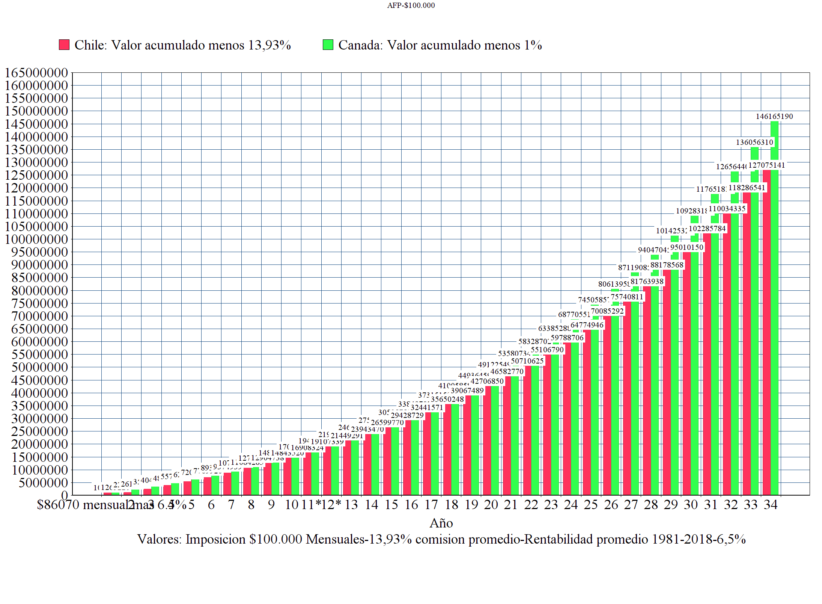

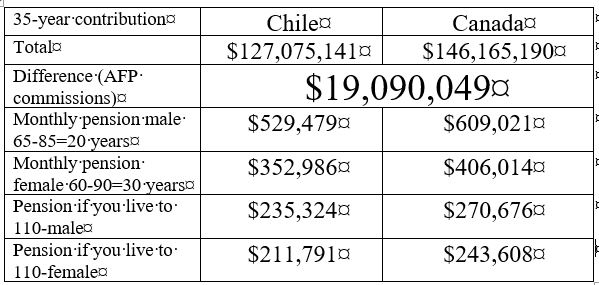

The actual commission structure in Chile averages 13.93%. This compares with Canada, which only charges 1% for investing your money for a secure monthly pension payment.

Putting this into numbers (not realistic pension contribution amounts though, since Investigación de Fundación Sol tells us that 91% of retirees receive less than $150,000 monthly).

If $100,000 is discounted monthly from your paycheck for your AFP, only $86,070 go to your pension fund. The other $13,930 goes directly to the AFP as commission.

This chart shows what an enormous difference these commissions make over a 35-year period:

Adding salt to the open wound, the AFP’s get paid regardless of whether you make money, or not.

As of September 2019, the AFP’s had made +70.26% (42.5% since inception) in profit, year-over-year, while Chileans have had a meager 6.5% average return on their investments from 1980-2019.

This means that the first 12 years of your contributions go towards paying AFP commissions; the rest is yours.

Time for a change, no?